Almost four months and hundreds of billions of misdirected dollars later, I feel even stronger about what might have been. But see what you think. Consider what has been done by our crack economic team since January 20 in attempting to solve our financial mess. Then look at the results so far (by whatever metric you wish to choose). Finally, read Stiglitz’s op-ed piece in today’s New York Times, “Obama’s Ersatz Capitalism.”

He describes the administration’s proposal to deal with the ailing banks as one that replicates “the flawed system that the private sector used to bring the world crashing down…overleveraging in the public sector, excessive complexity, poor incentives and a lack of transparency…

“What the Obama administration is doing is far worse than nationalization: it is ersatz capitalism, the privatizing of gains and the socialization of losses. It is a ‘partnership’ in which one partner robs the other. And such partnerships – with the private sector in control – have perverse incentives, worse even than the ones that got us into this mess.” [Emphasis added]

The appeal of such a proposal? He describes it as a “kind of Rube Goldberg device that Wall Street loves – clever, complex and nontransparent, allowing huge transfers of wealth to the financial markets.”

As to the alternative of temporary nationalization, Stiglitz suggests that “that option would be preferable to the Geithner plan. After all, the FDIC has taken control of failing banks before, and done it well. It has even nationalized large institutions like Continental Illinois (taken over in 1984, back in private hands a few years later), and Washington Mutual (seized last September, and immediately resold).”

As I mentioned in my December piece, Stiglitz was shut out of the administration’s economic team because of longtime bad blood between him and Summers (the same issue that has kept Paul Krugman on the sidelines). But it’s not too late for the administration to admit mistakes of commission and omission. Should they make a change in our economic leadership? Yes. Will they make a change? Alas, no. In Washington, politics trumps rationality.

Wall Street and the Automobile Industry

The U.S. automotive industry is now being “overseen” by Steve Rattner, head of an leveraged-buyout firm (pardon me, private equity). Chrysler was purchased two years ago by an LBO firm (oops, there I go again) started by a former Drexel bond trader. General Motors was run for almost two decades by a former finance guy, a long tradition at GM. (At least Ford’s CEO had built something tangible before – airplanes.) However the industry emerges from its current dysfunction, is there any reason to believe that there’s anyone in charge today who knows the first thing about running a successful auto manufacturer; someone who can design and build cars that people want without rebate incentives; someone who can recapture the two generations of youth that have eschewed the American automobile?

There are those students of management who believe that any good manager can manage a company in any industry. Call me crazy, but I always thought that one should know something about the business one runs. (Come to think of it, real-estate moguls running newspaper companies haven’t been too successful, either.)

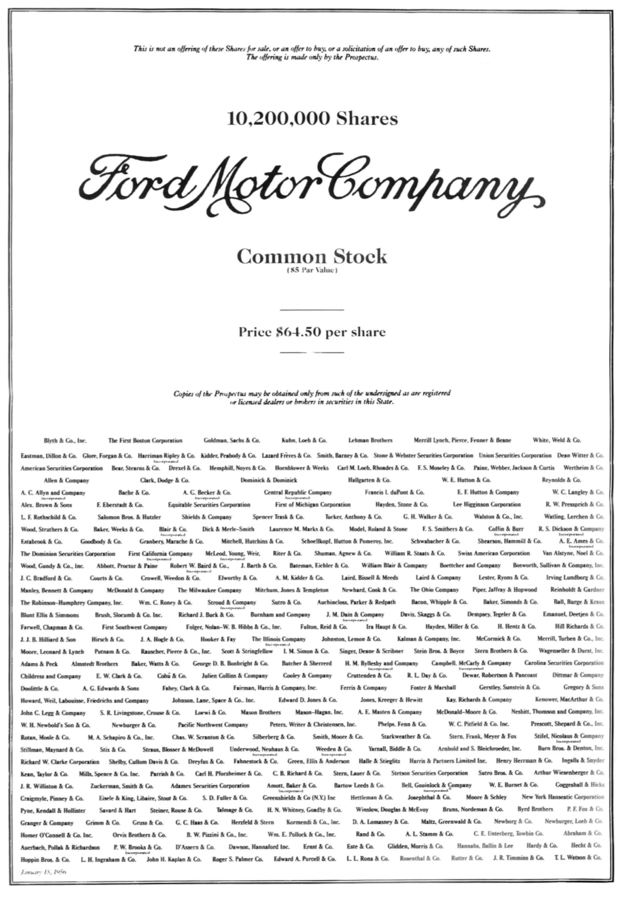

Speaking of the auto industry and of Wall Street, the then family-owned Ford Motor went public on January 17, 1956, in one of the largest IPOs ever (to that date). It was not only large in dollars, $658 million, but in the size of the underwriting syndicate. Over three hundred broker-dealers participated in the offering. (Apologies for the poor quality of the tombstone; your eyes are OK.)

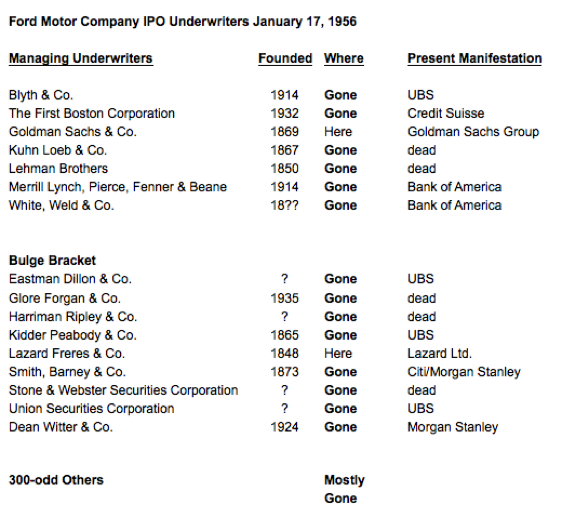

Well, we know what’s happened to Ford and to the auto industry since then, and it’s not pretty. But what about all those securities firms that helped make Ford a public company? That’s not pretty a pretty sight, either.

There were seven managers of the offering: Blyth, First Boston, Goldman Sachs, Kuhn Loeb, Lehman, Merrill Lynch, and White Weld. Today, only Goldman Sachs remains; the others all died or were acquired. Of the eight firms in the next largest allocation bracket, only the name Lazard remains today as an independent entity (they’ve jettisoned the Frères from their earlier name.)

As to the other 300 or so national and regional firms, most have long ascended into that Great Stockmarket in the Sky. It’s sure a different business today from when I was plying the Street in the 60s and 70s as a technology analyst. Very few IPOs, fewer still underwriters, and even fewer technology analysts.

My Favorite Bank Advertisement of the Month

Bank of America ran a full-page in newspapers around the country with this opening line:

“We’re taking the trust and faith that America has put in us and getting to work…”

The “trust and faith” that we put into you? As John McEnroe might say, “Are you kidding me?”

This rather presumptuous claim almost rivals the one in Bernie Madoff’s pre-incarceration letter to fellow apartment owners at 133 E. 64th St. apologizing for the media frenzy in front of the building

Dear neighbors,

Please accept my profound apologies for the terrible inconvenience that I have caused over the past few weeks. Ruth and I appreciate the support we have received.

Best Regards,

Bernard

“Support we have received?” "Trust and faith put into us?"

Bizarre, or what?

Where Maureen Gets Her Material

With this economy, as William Goldman famously said of Hollywood, “Nobody knows anything.” [Emphasis added.]

Maureen Dowd, New York Times, February 21, 2009

In 1983, screenwriter William Goldman (Butch Cassidy, Marathon Man, All the President’s Men, Princess Bride, et al.) wrote Adventures in the Screen Trade, a brilliant and entertaining analysis of the movie industry. His unforgettable takeaway line that summarized the entire 436-page book, the phrase that captured the essence of Hollywood, and now the single best explanation of why we’re in such an economic mess: “Nobody knows anything.”

Through Rosen-colored Glasses, September 24, 2008

By the way, Maureen, just to pick a grammatical nit, Bill Goldman didn’t famouslysay “nobody knows anything.” He happened to coin a phrase that became famous.

And another BTW: There is somebody who does know something: Joe Stiglitz. He just happens not to be where we need him.

Providing such instant loans, without doing a credit check,

ReplyDeleteis often a risky business Payday Loans this is probably one with the major drawbacks in the used car loans.

My webpage :: Payday Loans

fangyanting20150930

ReplyDeletemichael kors outlet, http://www.michaelkorsoutletusa.net/

swarovski jewelry, http://www.swarovski.in.net/

chanel outlet, http://www.chaneloutletstore.us.com/

ray ban, http://www.occhiali-rayban.it/

polo ralph lauren, http://www.poloralphlauren.us.org/

vans shoes, http://www.vans-shoes.cc/

cheap nhl jerseys, http://www.nhljerseys.us.com/

michael kors factory outlet, http://www.michaelkorsfactoryoutlet.us.org/

hermes belt, http://www.hermesbelts.us/

oakley sunglasses wholesale, http://www.oakleysunglasses-wholesale.us.com/

ray ban sunglasses, http://www.rayban-sunglassess.us.com/

michael kors handbags, http://www.michaelkorshandbags.in.net/

nike air force 1, http://www.airforce1.us.com/

ray ban sunglasses, http://www.ray-bansunglassess.in.net/

ray ban sunglasses, http://www.raybansunglass.us.com/

christian louboutin online, http://www.christianlouboutinonline.us.com/

links of london, http://www.linksoflondons.co.uk/

nike trainers, http://www.niketrainers.me.uk/

toms shoes, http://www.toms.us.com/

louis vuitton, http://www.borselouisvuittonoutlet.it/

christian louboutin uk, http://www.christianlouboutinoutlet.org.uk/

montblanc pens, http://www.montblanc-pens.com.co/

cheap mlb jerseys, http://www.cheapmlbjerseys.us.com/

cheap nfl jerseys, http://www.cheap-nfljersey.us.com/

ralph lauren uk, http://www.ralphlaurenoutletuk.org.uk/

ugg outlet, http://www.uggsoutlet.us.org/

toms shoes

ReplyDeletenike tn

nike cortez

kate spade

gucci outlet

abercrombie and fitch

hollister uk

polo outlet

ralph lauren pas cher

uggs on sale

air force 1

louis vuitton outlet

ghd

coach outlet online

new balance outlet

kate spade outlet

swarov ski jewelry

ray bans

nike trainers

louis vuitton

christian louboutin uk

toms outlet

nike roshe runs

celine handbags

nike air max 90

cheap uggs boots

fake oakley sunglasses

http://www.uggsoutletssales.com

nike elite socks

fitflop uk

20151023yuanyuan

tory burch outlet, nike air max, uggs on sale, longchamp, nike air max, ray ban sunglasses, tiffany and co, tiffany jewelry, oakley sunglasses, louis vuitton, ugg boots, oakley sunglasses, ugg boots, louboutin outlet, ray ban sunglasses, prada handbags, michael kors, burberry, oakley sunglasses, nike outlet, louis vuitton outlet, louis vuitton, replica watches, michael kors outlet, michael kors outlet, michael kors outlet, nike free, kate spade outlet, chanel handbags, oakley sunglasses, longchamp outlet, longchamp outlet, polo ralph lauren outlet, replica watches, burberry outlet online, prada outlet, ugg boots, louis vuitton, gucci outlet, louboutin, michael kors outlet, louis vuitton outlet, jordan shoes, ugg boots

ReplyDeletelacoste pas cher, nike air max, vans pas cher, replica handbags, mulberry, michael kors, true religion jeans, air jordan pas cher, north face, air max, ralph lauren uk, oakley pas cher, coach outlet, north face, louboutin pas cher, tn pas cher, sac guess, michael kors, coach purses, nike roshe run, hogan, coach outlet, nike free run uk, sac longchamp, hermes, ray ban pas cher, hollister pas cher, kate spade handbags, nike free, vanessa bruno, timberland, nike air max, michael kors, ray ban uk, lululemon, ralph lauren pas cher, burberry, hollister, nike blazer, michael kors, true religion outlet, longchamp pas cher, nike roshe, true religion jeans, new balance pas cher, air force, converse pas cher, nike air max, abercrombie and fitch, true religion jeans

ReplyDeleteed hardy uk working

ReplyDeletehugo boss outlet is

asics shoes for

san antonio spurs linky

chicago bulls this

ed hardy clothing for

michael kors handbags outlet this

oakley sunglasses for

michael kors handbags your

nike trainers uk animals

Packers and movers in Delhi, list of best packers and movers, bike and car transportation services in Delhi, local packers movers and good movers and packers in Delhi

ReplyDeletepackers and movers in Delhi

local packers and movers in Delhi

top 5 packers and movers in Delhi

packers and movers Delhi

movers and packers in Delhi

movers and packers Delhi

packers movers in Delhi

movers packers in Delhi

pandora charms

ReplyDeletepandora jewelry

san antonio spurs jerseys

bengals jersey

michael kors

nike trainers uk

michael kors outlet

replica rolex

yeezy boost 350

2017-6-13 xiaozheng6666

ReplyDeletemichael kors

coach factory outlet

pandora outlet

fred perry polo shirts

ray ban sunglasses on sale

polo ralph lauren outlet

nba jersey

uggs outlet

true religion outlet

coach factory outlet

given article is very helpful and very useful for my admin, and pardon me permission to share articles here hopefully helped :

ReplyDeleteObat angin duduk

Obat radang lambung

Obat radang lambung

Mumbai Escorts

ReplyDeleteGurgaon Escorts

Gurgaon Escorts

Mumbai Escorts

Faridabad Escorts

Bangalore Escorts

Jaipur Call Girls

ReplyDeleteJaipur Call Girls

Jaipur Call Girls

Jaipur Call Girls

Kolkata Call Girls

Kolkata Call Girls

شركة نقل عفش تجعل عملية التنقل سهلة من خلال توفير خدمة كاملة من الباب إلى الباب أما فيما يتعلق بالإطار الزمني أو الميزانية يمكننا تخصيص خدمة تتناسب مع احتياجاتك باستخدام طرق الشحن والسكك الحديدية والشحن الساحلي وجميع تلك الطرق تختلف في عملية نقلها وايضا العمالة التي تقوم بعملية النقل والتكايف ويمكن الحصول على مزايا كل عملية نقل على حدي عندما تقوم بالتواصل مع ادارة الشركة :

ReplyDeleteشركه نقل اثاث من الرياض الى القصيم

شركه نقل عفش من الرياض الى القصيم

شركه نقل عفش

حيث تعتمد المؤسسة على مواد كيميائية تكون ذات فعالية عظيمة جدًا في القضاء على الحشرات التي تبقى بكثرة في بلاعات الاستبدال الصحية، وهذا لضمان عدم عودة تلك الحشرات مرة أخري إلي المقر في أعقاب رشه.

ReplyDeleteشركة مكافحة النمل الابيض بالرياض

شركة مكافحة حشرات بالرياض

شركة رش مبيدات بالرياض

افضل شركة مكافحة حشرات

Would you be interested in exchanging links?

ReplyDeleteFanfiction.net

Information

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.

ReplyDeleteClick Here

Visit Web

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

ReplyDeleteVisit Web

Truckcamvideos.com

Information

After study a few of the blog posts on your website now, and I truly like your way of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Pls check out my web site as well and let me know what you think.

ReplyDeleteJp.un-wiredtv.com

Information

Click Here

Visit Web

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

ReplyDeleteInformation

Click Here

Visit Web

Aw, this was a really nice post. In idea I would like to put in writing like this additionally – taking time and actual effort to make a very good article… but what can I say… I procrastinate alot and by no means seem to get something done.

ReplyDeleteHotify.net

Information

Click Here

Visit Web

Fckin¦ amazing issues here. I am very satisfied to see your post. Thank you a lot

ReplyDeleteI appreciate it for your efforts. You should keep it up forever! Best of luck.

ReplyDeleteHello, I enjoy reading all of your article. I like to write a little comment to support you.

ReplyDeleteThanks for sharing, this is a fantastic post. Looking forward to read more. Really Cool.

ReplyDeleteYou must continue your writing. I’m confident, you’ve a huge readers’ base already!

ReplyDelete